"Your Local Tax Problem Solvers Since 1992"

ORLANDO: 407-915-3470

TAMPA: 813-708-5530

When the IRS engages in enforced collection of a tax debt it almost always begins with an IRS wage garnishment or an IRS bank levy.

When the IRS engages in enforced collection of a tax debt it almost always begins with an IRS wage garnishment or an IRS bank levy.

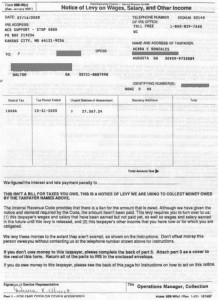

The IRS will serve what is known as a Notice of Levy (the “IRS Levy”) on all of the taxpayer’s known financial institutions and employers.

A Wage Levy takes effect immediately upon receipt and the taxpayer’s employer must pay over to the IRS the proper IRS levy amount on each payday the levy remains in effect.

Generally, a bank must freeze your account for 21 days from the date of the Bank Levy before it is required to turn over the funds to the IRS. This gives the taxpayer, the bank and the IRS an opportunity to resolve the matter before the taxpayer’s funds are lost.

The IRS usually will not resort to the issuance of bank levies and wage garnishments until after it has made several attempts to contact the taxpayer and resolve the matter amicably through the use of an IRS collection alternative such as voluntary payment, an installment payment plan or an IRS settlement (“Offer in Compromise”).

Often our clients’ first contact with us is after the IRS has begun enforced collection and has issued an IRS wage levy, an IRS bank levy or both.

The tax attorneys, CPAs, and IRS enrolled agents in our Orlando and Tampa tax offices regularly help taxpayers get their IRS wage levies released (see photo below for copy of release of levy); however, it is often a difficult job because the IRS, having been ignored by the taxpayer prior to our engagement, is now in no mood to make concessions to the taxpayer.

If you have gotten any kind of collection notice from the IRS it is wise to call a tax professional to discuss the potential consequences of IRS action.

The earlier you address your IRS tax problems the better your chances of obtaining a favorable outcome. Contact us today

In short, the absence of IRS dunning notices is more troublesome than their presence because it signals a possible, and in many cases likely, IRS criminal referral.

Contact The Pappas Group in Orlando immediately upon receipt of the first IRS notice you get demanding payment of back taxes or requesting the filing of an unfiled return for a free consultation and evaluation of your case.

The IRS audited my 2007 and 2008 tax returns and disallowed 100% of my business expenses because the auditor said I didn’t have sufficient records. I hired The Pappas Group and they were able to prove by other means that my deductions were valid and the IRS ended up only disallowing about 15% of my expenses. Had I not hired Pappas I would been assessed taxes, penalties and interest in excess of $100,000. The Pappas group now does all of my accounting work and prepares both my business and personal tax returns.